Tay Valley Township’s ‘My Account’ is live!

This allows property owners to view, store or print current and previous tax bills, pay taxes, and sign up for pre-authorized payments (PAP), all online. Lawyers can also print tax certificates and pay for them online.

| What is 'My Account'? |

|

Creating your virtual My Account allows you to view, print and pay your property taxes, all online. The self-serve program allows you to change your mailing address, customize your paperless notification settings and start, stop or change a Pre-Authorized Payment (PAP) plan for your property taxes. |

| How do I set up 'My Account'? |

|

You will need a copy of your current tax bill or property roll number to get started. A User Guide is available to assist you. |

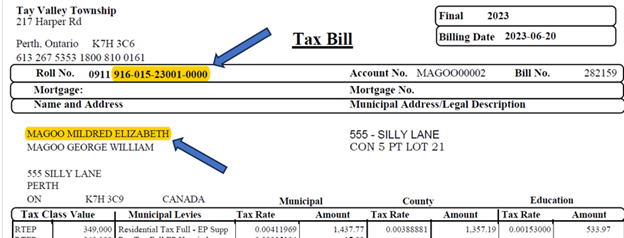

| What is a property roll number and where can I find mine? |

|

A roll number tells you everything you need to know about where a property is located. Think of a roll number as your property's personal ID! It is used by the Municipal Property Assessment Corporation (MPAC) for your property assessment and tax levy. This is also the number the municipality uses for your property taxes. This number can be found on your tax bill. |

| What are Pre-Authorized Payments (PAP)? And what do I need to know about it? |

|

Pre-Authorized Payments (PAPs) are automatic monthly withdrawals from your bank account to be applied against your tax account. A withdrawal comes out of your bank account automatically on the 15th of every month. The PAP annual cycle starts every November, and ends in October. The municipality will calculate your monthly amount based on your previous year’s taxes and divide it by 12 months. A letter will be sent in October notifying you of your monthly payment. This will be your monthly amount for the first 9 months (November to July). Then once the final tax bills are calculated a revised amount will be provided to you in a letter and this will be your payment for the remaining 3 months of August, September, and October. Your tax account must be up to date before you begin. You will still receive a property tax bill for your records. You can cancel at any time. There are no charges or fees to set up pre-authorized payments. Non-Sufficient Funds (NSF) or any returned cheques are subject to an administration fee of $35.00. |

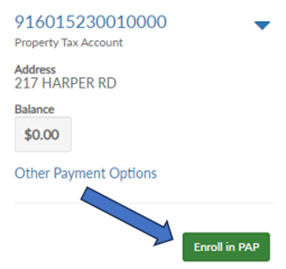

| How do I sign up for Pre-Authorized Payments (PAPs)? |

|

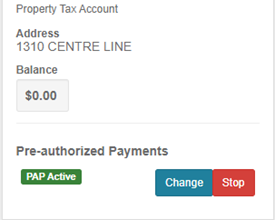

After signing up for ‘My Account’, under the property tax account you wish to sign up for Pre-Authorized Payments (PAPs) click ‘Enroll in PAP’.

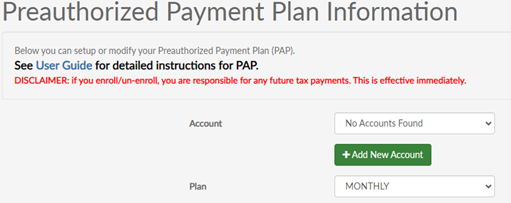

Then, either select an existing bank account (that you would have previously added) or click the “+ add a new account” and add your banking information. Note: if you get an error when adding the bank account, click the Back button and then the Home button - your banking information will have been saved. You can then proceed to select your plan type. Next, select your payment plan. Note: Tay Valley only offers a monthly PAP option at this time. Review the terms and conditions and the additional information before clicking Save and Accept.

To stop an existing PAP plan, Click- ‘ Stop’ |

| What is eBilling (Paperless Notifications)? Will I still get a paper copy when I sign up for eBilling? |

|

eBilling (Paperless Notifications) is where your tax bill is sent to your email on file opposed to receiving a paper copy in the mail. By signing up for eBilling you will no longer be sent a paper tax bill. It will remain your responsibility to track and pay the bills by the indicated due dates. You must notify the municipality in the event that your email address changes. If you have multiple properties eBilling must be completed for each property. |

| What are the benefits of signing up for eBilling (Paperless Notifications)? |

|

You do not have to wait for your bills to come in the mail. Never misplace a bill. When signed up for ‘My Account’ Billing will allow you to view, store and print your e-bills for your records. Paperless is a great way to become more environmentally friendly. Never miss a bill because your mailing address has changed. |

| Where can I sign up for eBilling (Paperless Notifications)? |

|

Under Account listing, click- ‘Sign up for eBilling’ Then read the text box fully before clicking ‘Click to Accept’ |

| Can I print my tax bill? |

|

Yes, if you are set up for eBilling you will be able to view and print previous eBills that were sent to you. If you are not signed up for eBilling you will not be able to view and print your actual tax bill, but you will have access to the information that your tax bill provides (ex: assessment, amounts due, ownership information, etc.) |

| Will I get a receipt? |

|

By signing up for ‘My Account’ you can print receipts at home after credit card payment has been made through 'My Account'. |

| If I do not want to pay my taxes through ‘My Account’ what are my options? |

| Visit Property Taxes - Tay Valley Township (tayvalleytwp.ca) |

| How do I change my email and mailing address? |

|

You can also change your mailing address or email address on file by completing the appropriate form. |

| How can I stay up to date on changes? |

| To stay up to date on property tax updates as well as other Township information subscribe to eNews. |

To change an existing PAP plan, click - ‘Change’.

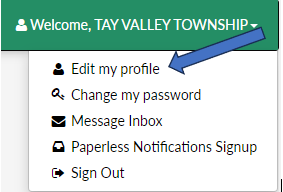

To change an existing PAP plan, click - ‘Change’.  After signing up for ‘My Account’, you go to ‘Edit my profile’ to manage your email and mailing address on file.

After signing up for ‘My Account’, you go to ‘Edit my profile’ to manage your email and mailing address on file.